What Is The Social Security Earnings Limit For 2025. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you. Keep these updated figures in mind if you're.

In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every $2 you earn. The maximum benefit amount, however, is more than double that.

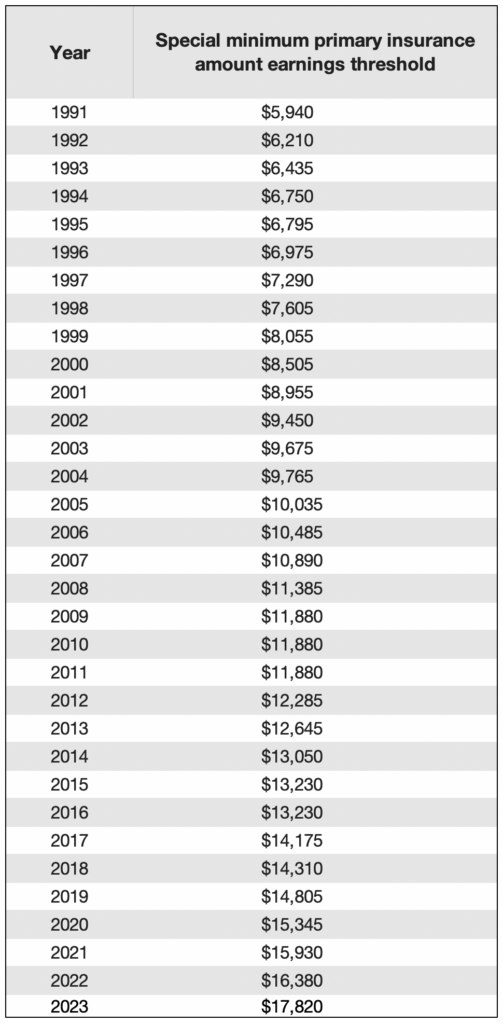

If you are working, there is a limit on the amount of your earnings that is taxed by social security.

As of 2025, the maximum social security benefit is $4,873 per month, an attractive amount that many will aim for.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Limit For Maximum Social Security Tax 2025 Financial Samurai, In 2025, social security will allow you to make $22,320 a year being retired. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

What Is The Social Security Earnings Limit For 2025 Amii Lynsey, Here's a look at the most you can. Social security and supplemental security income, or ssi, will increase by 3.2% in 2025, the social security administration announced thursday.

What is the Minimum Social Security Benefit? Social Security Intelligence, In 2025, the earnings limit for early claimants is $22,320. (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits for every $2 in.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age, But if you reach fra in 2025, the limit on your earnings for the months before. In 2025, you can earn up to $22,320.

Social Security’s Monthly Limit for Retirement Benefits Most, That is up from $160,200 in 2025. The 2025 and 2025 limit for joint filers is.

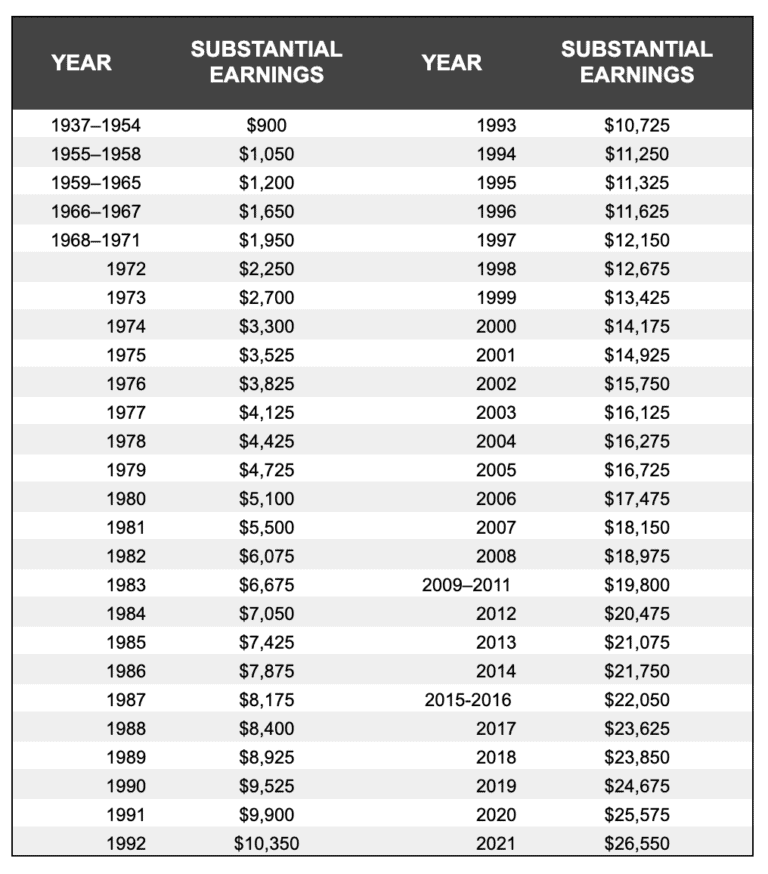

Substantial Earnings for Social Security’s Windfall Elimination, If your gross benefit before deductions for things like medicare. Social security limit for 2025 social security genius, the estimated average social security benefit for retired workers in 2025 is $1,907 per month.

Social Security Tax Limit 2025 Know Taxable Earnings, Increase, The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. In 2025, social security will allow you to make $22,320 a year being retired.

Social Security Tax 2025 Limit Fifi Katusha, If you're teetering on the earnings limit and unsure where you. If your gross benefit before deductions for things like medicare.

Social Security Limit for 2025 Social Security Genius, What is the social security tax limit? In 2025, you can earn up to $22,320.

This higher exempt amount applies only to earnings made in months prior to the month of nra attainment.